![]() It uses the Support Vector Machine (SVM) technique with a kernel of the linear type.

It uses the Support Vector Machine (SVM) technique with a kernel of the linear type.

![]() A "bad customer" is a customer who is more than 90 days in arrears.

A "bad customer" is a customer who is more than 90 days in arrears.

![]() It provides the estimate of the risk associated with new applications.

It provides the estimate of the risk associated with new applications.

![]() Excellent tool to discriminate a portfolio of clients.

Excellent tool to discriminate a portfolio of clients.

For the model, the technique used is Support Vector Machine (SVM) with a linear kernel, defining a "bad customer" as those who are more than 90 days in arrears and/or more than 5 UF (Unidades de Fomento).

The model applies the database in two parts: the first, with an X% Trainning, to perform the corresponding adjustments and modelling, while the remaining (1-X)% Test to which all goodness-of-fit tests were performed.

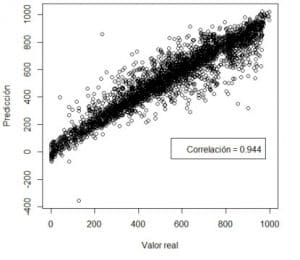

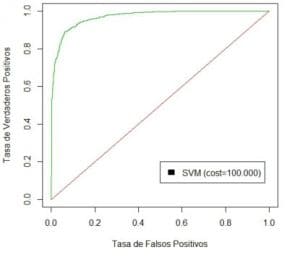

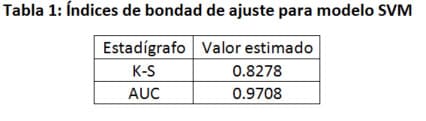

One of the ways to measure the model's goodness-of-fit was by comparing the actual values of previous behaviour versus the predictions of our fitted model. In addition, out of the 36 variables selected, two were eliminated, since the algorithm defined them as constants. Thus, the results of the fit are presented below in the graphs.

Performance of the Applicant Scoring Expert Choice model

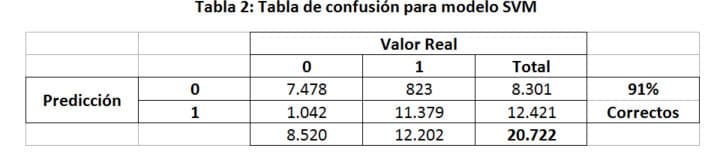

As we can clearly see from the results shown above, a 91% correct classification was obtained between the actual values and the predictions delivered by the model. The generalisation of this technique is very effective in classifying good and bad customers ("Payers" from "Non-Payers").

The benefits of SVM techniques, its great capacity to generalise and its small number of parameters that need to be adjusted, have shown that it is an excellent tool to be applied when discriminating a customer portfolio.

Application Scoring models provide essential support in estimating the risk associated with new credit applications. They allow clients to be ranked according to how good or bad their credit is.

The ranking is done by weighting demographic data, socio-economic data, operational data, etc.

In the case of reactive models, these variables are obtained from the data provided by the client when applying for the loan. In the case of proactive models, they are obtained from the client's payment history, in addition to the client's history of entering the financial institution.

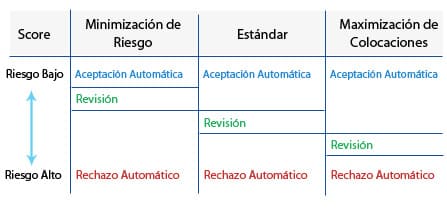

This procedure compares the score already generated against a minimum value ("cut-off") associated with the profitability risk that the financial institution wishes to define.

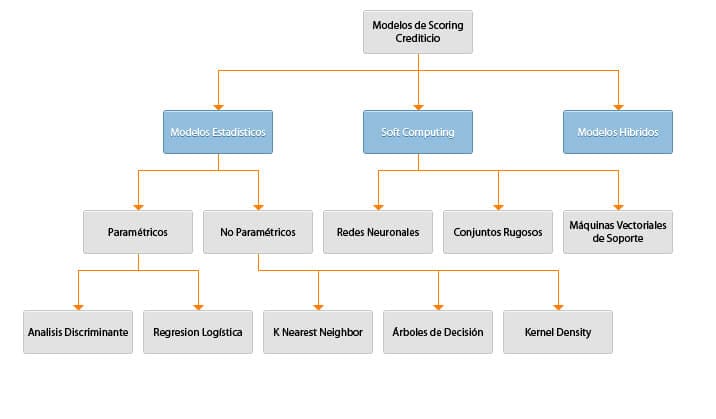

Application Scoring Techniques

Human judgement, i.e. an analyst's decision to grant a credit, is an ultimate tool for the approval or denial of a credit. It is mainly effective in the case of exceptions. Scoring construction methods are more efficient and allow to analyse and make decisions on a large number of credit applications in a short time.

Customisation hh hh

(Start up) [2] [3] [3]

Monthly blackboard price

(Unlimited use of licences and unlimited use of consultations) [1] [1].

USD 9.500,00

+ VAT

[1] Technical operation of the platform, backups and maintenance in Expert Choice environment.

[2] Maintenance and operations contract for one year.

[3] Java language development.

Facebook

Facebook Twitter

Twitter LinkedIn

LinkedIn Google+

Google+ Youtube

Youtube